Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Quick Links

Check out the GGP Sponsors!

Categories

Check out the GGP Sponsors!

In this Discussion

That's a wrap! Thanks for a great season. See you all next year!

We should be shooting 2nd Saturday and 4th Sunday again next year.

Final schedule to be finalized in February.

We should be shooting 2nd Saturday and 4th Sunday again next year.

Final schedule to be finalized in February.

Illinois Politicians Plot New Assaults on Gun Ownership

dd

Gnome, gnome on the range!

dd

Gnome, gnome on the range!

<div class="IPBDescription">From the ISRA</div>[font="Arial"][size="2"] <br />

<br />

<br />

<br />

<br />

[font=Arial, Helvetica, sans-serif][size="+0"]Illinois Politicians Plot New Assaults on Gun Ownership[/size][/font]<br />

<br />

[font=Arial, Helvetica, sans-serif]Gun owners in Illinois are bracing for a fight against the latest round of legislation aimed at inhibiting their right to keep and bear arms. With efforts to essentially ban the ownership of firearms having been struck down by the Supreme Court, and Illinois now standing as the only state that makes no provision for legal concealed carry of firearms, leftist politicians in Chicago and throughout the state are far from conceding defeat. <br />

<br />

This time, according to critics, they are attempting to interfere with the free exercise of Second Amendment liberties by simply taxing gun ownership and use beyond the means of many residents. <br />

<br />

Taxation has often been used as a means of social coercion; so-called sin taxes on alcohol and cigarettes, for example, have been used as a means of supposedly discouraging the use of such products, while providing the government with a lucrative means of taxing the public in addition to many other forms of property, income, and sales taxes that regularly assault the publics pocketbooks. Now, Kelly Cassidy (D-Chicago), a member of the Illinois legislature, is proposing a similar sin tax on ammunition. At the same time, Chicago Mayor Rahm Emanuel is pushing for a new statewide handgun registry that would not only impose an onerous burden on gun owners ($65 per firearm), but would also create a massive state database tracking the location and ownership of every firearm in the state. <br />

<br />

Cassidys bill to increase the taxes on ammunition is supposedly intended to fund a high-crime trauma center grant fund by means of a two-percent surtax on ammunition. The grant fund would then be used to give financial assistance to trauma centers in high-crime areas. An article by Judson Berger for FoxNews explains the logic behind the new tax: <br />

<br />

The idea is to begin to offset the high cost of gun violence. Mark Walsh, campaign director for the Illinois Campaign to Prevent Gun Violence, told FoxNews.com that cost often ends up being shouldered by these urban trauma centers. <br />

<br />

"[The money would go] into communities here in Illinois that have been damaged with gun violence," he said. "I think it's a legitimate way to pursue funding." <br />

<br />

Cassidy filed the bill (HB 5167) on February 8; nine days later it was assigned to the executive committee. According to the text of the legislation, the new tax would come into effect at the beginning of next year: <br />

<br />

Beginning January 1, 2013, in addition to all other rates of tax imposed under this Act, a surcharge of 2% is imposed on the selling price of firearm ammunition, except firearm ammunition purchased by the Department of Natural Resources. "Firearm" and "firearm ammunition" have the meanings ascribed to them in Section 1.1 of the Firearm Owners Identification Card Act. <br />

<br />

The legislation also specifies that all the funds raised through the new surcharge would be distributed monthly to designated trauma centers: <br />

<br />

Beginning January 1, 2013, the Department shall pay into the High Crime Trauma Center Grant Fund 100% of the net revenue realized for the preceding month from the 2% surcharge on the selling price of firearm ammunition. <br />

<br />

Critics of the legislation, including Richard Pearson of the Illinois State Rifle Association, view the new ammunition surcharge as one that taxes gun owners especially those in rural areas to pay the costs for Chicagos high crime rate. As Pearson told FoxNews: <br />

<br />

"We aren't causing the problem. They are," Pearson said. "It's an attack on firearm owners and their rights.... They think that because we like to target shoot and hunt, we're bad people, and we should pay for all the ills of the city of Chicago." <br />

<br />

The Fox story continued, <br />

<br />

Since gun owners in Illinois have to have a special ID card which requires a background check to obtain, Pearson said those committing crimes of gun violence aren't likely to be paying much into the proposed tax fund. <br />

<br />

"They're not buying their ammunition [legally]. They're not paying any part of the tax. They're getting their stuff illegally," he said.... <br />

<br />

Read the whole story [url="http://www.thenewamerican.com/usnews/constitution/10978-illinois-politicians-plot-new-assaults-on-gun-ownership"]here [/url] from The New American Magazine<br />

<br />

Posted Fri Feb 24 08:45:38 CST 2012[/font]<br />

<br />

[/size][/font]

<br />

<br /><br />

<br />

<br />

[font=Arial, Helvetica, sans-serif][size="+0"]Illinois Politicians Plot New Assaults on Gun Ownership[/size][/font]<br />

<br />

[font=Arial, Helvetica, sans-serif]Gun owners in Illinois are bracing for a fight against the latest round of legislation aimed at inhibiting their right to keep and bear arms. With efforts to essentially ban the ownership of firearms having been struck down by the Supreme Court, and Illinois now standing as the only state that makes no provision for legal concealed carry of firearms, leftist politicians in Chicago and throughout the state are far from conceding defeat. <br />

<br />

This time, according to critics, they are attempting to interfere with the free exercise of Second Amendment liberties by simply taxing gun ownership and use beyond the means of many residents. <br />

<br />

Taxation has often been used as a means of social coercion; so-called sin taxes on alcohol and cigarettes, for example, have been used as a means of supposedly discouraging the use of such products, while providing the government with a lucrative means of taxing the public in addition to many other forms of property, income, and sales taxes that regularly assault the publics pocketbooks. Now, Kelly Cassidy (D-Chicago), a member of the Illinois legislature, is proposing a similar sin tax on ammunition. At the same time, Chicago Mayor Rahm Emanuel is pushing for a new statewide handgun registry that would not only impose an onerous burden on gun owners ($65 per firearm), but would also create a massive state database tracking the location and ownership of every firearm in the state. <br />

<br />

Cassidys bill to increase the taxes on ammunition is supposedly intended to fund a high-crime trauma center grant fund by means of a two-percent surtax on ammunition. The grant fund would then be used to give financial assistance to trauma centers in high-crime areas. An article by Judson Berger for FoxNews explains the logic behind the new tax: <br />

<br />

The idea is to begin to offset the high cost of gun violence. Mark Walsh, campaign director for the Illinois Campaign to Prevent Gun Violence, told FoxNews.com that cost often ends up being shouldered by these urban trauma centers. <br />

<br />

"[The money would go] into communities here in Illinois that have been damaged with gun violence," he said. "I think it's a legitimate way to pursue funding." <br />

<br />

Cassidy filed the bill (HB 5167) on February 8; nine days later it was assigned to the executive committee. According to the text of the legislation, the new tax would come into effect at the beginning of next year: <br />

<br />

Beginning January 1, 2013, in addition to all other rates of tax imposed under this Act, a surcharge of 2% is imposed on the selling price of firearm ammunition, except firearm ammunition purchased by the Department of Natural Resources. "Firearm" and "firearm ammunition" have the meanings ascribed to them in Section 1.1 of the Firearm Owners Identification Card Act. <br />

<br />

The legislation also specifies that all the funds raised through the new surcharge would be distributed monthly to designated trauma centers: <br />

<br />

Beginning January 1, 2013, the Department shall pay into the High Crime Trauma Center Grant Fund 100% of the net revenue realized for the preceding month from the 2% surcharge on the selling price of firearm ammunition. <br />

<br />

Critics of the legislation, including Richard Pearson of the Illinois State Rifle Association, view the new ammunition surcharge as one that taxes gun owners especially those in rural areas to pay the costs for Chicagos high crime rate. As Pearson told FoxNews: <br />

<br />

"We aren't causing the problem. They are," Pearson said. "It's an attack on firearm owners and their rights.... They think that because we like to target shoot and hunt, we're bad people, and we should pay for all the ills of the city of Chicago." <br />

<br />

The Fox story continued, <br />

<br />

Since gun owners in Illinois have to have a special ID card which requires a background check to obtain, Pearson said those committing crimes of gun violence aren't likely to be paying much into the proposed tax fund. <br />

<br />

"They're not buying their ammunition [legally]. They're not paying any part of the tax. They're getting their stuff illegally," he said.... <br />

<br />

Read the whole story [url="http://www.thenewamerican.com/usnews/constitution/10978-illinois-politicians-plot-new-assaults-on-gun-ownership"]here [/url] from The New American Magazine<br />

<br />

Posted Fri Feb 24 08:45:38 CST 2012[/font]<br />

<br />

[/size][/font]

Comments

<br />

If the ammunition tax law passes, I suggest the Good Guy Posse repaint the trailer and hire a lawyer to make sure it gets designated as an approved trauma center. If ammunition components are not covered by the law, I predict an Illinois run on reloading equipment and components and we all better buy oxygen masks, to able to breathe after everyone switches over to blackpowder. <img src='http://www.goodguysposse.org/forums/public/style_emoticons/<#EMO_DIR#>/shellssm1.gif' class='bbc_emoticon' alt=':shellssm1:' /> <br />

<br />

<br />

I think the anti-gunners feel a CCW law is inevitable, even in Illinois, unless they do something drastic. They are pushing these draconian laws in the hopes of encouraging hard-core pro-gun people to move out of the state, and moderates to cease their CCW efforts in exchange for not having to pay more in shooting taxes.<br />

<br />

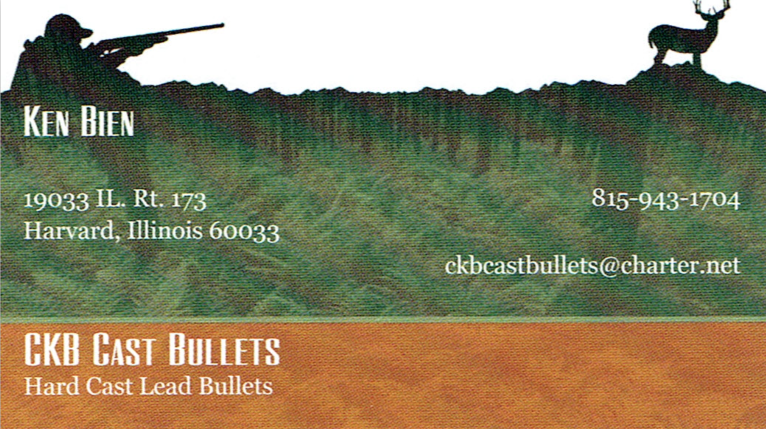

If the law does pass, it will benefit state-line stores selling ammo and components. Instead of paying a 2% sin tax to the state of Illinois, Posse shooters might make regular runs to Dam Road Mike's place or pay that 2% to [color="#006400"]Snidely Whiplash's Ammo Transfer Service[/color] for store-bought ammunition, unless their sales tax is lower than the 5.5% Snidely pays at Gander Mountain in Janesville.